DCW: Most Read in 2025

Since going fully online in May 2024, DCW has seen significant growth. The addition of eBooks, CPDs, an expanded archive,

Exploring the steps and considerations for banks to effectively navigate the complexities of true sale unfunded risk participation, identifying product and regulatory nuances, and understanding practical applications through use case scenarios.

In today's dynamic banking environment, achieving true sale risk participation is a crucial goal for banks. This approach enables banks to manage assets to optimize capital cost. Selling risk share or participating out risk to investors, when structured as true sale, allows the selling bank to remove sold assets from their balance sheets, thereby enhancing financial resilience and operational flexibility. However, the journey to achieving true sale participation, especially in the realm of Standby Letters of Credit (SBLC), is complex and requires careful navigation. In this article, we explore the steps and considerations essential for banks to effectively navigate the complexities of true sale unfunded risk participation, identify product and regulatory nuances, and understand practical applications through use case scenarios.

True sale risk participation holds significant implications for banks, directly impacting their capital reserves and regulatory compliance. Banks play a pivotal role in the global financial system and must maintain optimal capital levels to ensure resilience against economic challenges and systemic risks. By achieving true sale risk participation on unfunded assets (off-balance sheet instruments), banks can widen their efficiencies of scale through balance sheet optimization, freeing up capital for productive purposes such as lending and investment, thereby fostering economic growth.

US federal banking regulations impose heavier capital reserve requirements on domestic letter of credit (LC) issuers compared to their international peers [[1]]. Additionally, US regulations do not permit capital relief to domestic banks applying credit risk mitigants such as non-payment insurance. These disparities underscore the value for US banks to embrace the practical solution of unfunded risk participation to achieve capital relief on unfunded exposure.

When considering the capital reserve requirements for SBLCs under Basel III and US regulations, there are several additional nuances worth highlighting:

The differentiation in CCF reflects the regulatory perspective on the likelihood of an off-balance-sheet exposure becoming an actual credit exposure. Financial SBLCs, due to their nature of guaranteeing payments, are viewed as having a higher risk of being called upon, which justifies the 100% CCF. In contrast, performance SBLCs, which ensure the performance of contracts other than the payment of money, are deemed less likely to be drawn upon, resulting in the lower 50% CCF.

3. Leverage Ratio Consideration: In addition to risk-based capital requirements, banks are also subject to a minimum leverage ratio, which is a non-risk-based measure designed to restrict the amount of leverage banks can take on. The leverage ratio is calculated as Tier 1 capital divided by the bank's average total consolidated assets, and it does not directly consider the risk weight of assets or off-balance sheet exposures but does include off-balance sheet exposures in the denominator through CCF.

4. Liquidity Coverage Ratio and Net Stable Funding Ratio: While not directly related to capital requirements, these liquidity ratios are important for banks, especially those with significant off-balance sheet exposures like SBLCs. The LCR requires banks to hold enough high-quality liquid assets to cover net cash outflows for 30 days, while the NSFR requires a stable funding profile in relation to the composition of assets and off-balance sheet activities over a one-year period.

5. Stress Testing and Capital Planning: Large banks are also subject to stress testing requirements such as Comprehensive Capital Analysis and Review (CCAR) in the US and other stringent capital planning processes. These exercises test a bank's capital adequacy under adverse economic scenarios and incorporate a wide range of risk exposures, including those from SBLCs.

6. International Variations: While Basel III provides a global framework, its implementation can vary by country. In the US, regulations are enforced by the Federal Reserve, FDIC, and OCC, and may have specific interpretations or additional requirements.

7. Operational Risk: For advanced approach banks, capital requirements for operational risk can also impact the overall capital needs. This includes risks related to the execution, delivery, and management of SBLCs.

Understanding these nuances is crucial for managing regulatory capital requirements effectively, especially for large banks with substantial off-balance sheet exposures like SBLCs.

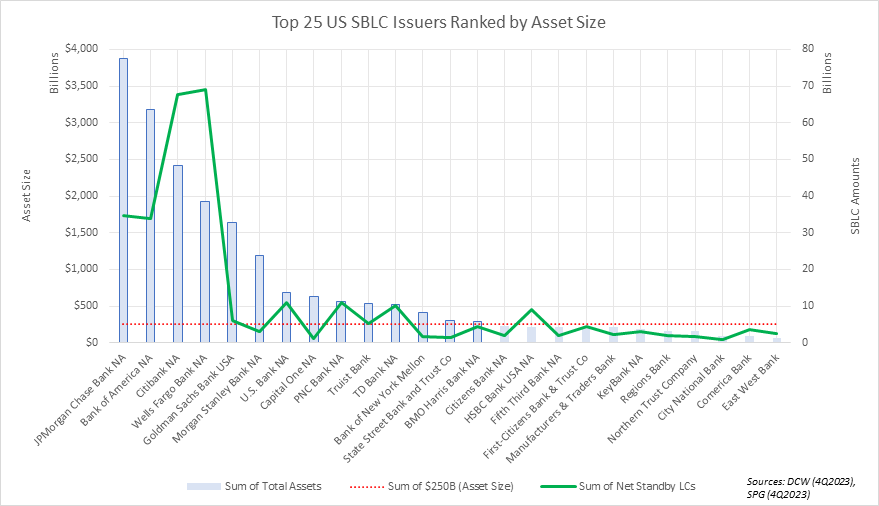

USD 250B+ US Bank

Notably, US banks with an asset size less than USD 250 billion operate, in general, under more favorable capital regulations. For a bank with an asset size of USD 250+ billion, which would categorically be considered a large, internationally active bank, the following capital requirements would be applicable under Basel III and US Regulations:

Therefore, the effective minimum CET1 ratio, including the CCB, would be 7% (4.5% + 2.5%), the effective minimum Tier 1 capital ratio would be 8.5% (6% + 2.5%), and the effective total capital ratio would be 10.5% (8% + 2.5%).

The 2.5% CCB is applicable to the capital requirements under Basel III, which has been implemented in the US through regulatory standards set by the Federal Reserve and other banking regulators. This buffer is in addition to the minimum capital requirements and is designed to ensure that banks build up capital buffers during normal times that can be drawn down during periods of economic stress.

For SBLCs and other off-balance sheet exposures, these capital requirements apply to the risk-weighted assets calculated after applying CCF and risk weights, as previously discussed. The CCB thus increases the total amount of capital that must be held against such exposures, enhancing the bank's resilience to losses and financial stress.

G-SIB Bank

A G-SIB, or Global Systemically Important Bank, is a major financial institution. Identified by international regulatory bodies like the Financial Stability Board and Basel Committee, these banks are crucial to global financial stability due to their size, interconnectedness, and impact on the financial system. They face stricter regulatory scrutiny and requirements to mitigate potential risks to the financial system.

To calculate the capital requirements for a US G-SIB with a USD 75 billion SBLC portfolio, where USD 10 billion of the portfolio consists of performance SBLCs and the remaining USD 65 billion consists of financial SBLCs, we'll follow the Basel III regulatory framework, incorporating both the standard capital requirements and the buffers for a G-SIB.

Assumptions and steps for the calculation will include applying the appropriate CCF, risk weights, and considering the G-SIB buffer in addition to the CCB and the minimum capital requirements.

Assumptions:

Steps:

For a US G-SIB with a USD 75 billion SBLC portfolio, consisting of USD 10 billion in performance SBLCs and USD 65 billion in financial SBLCs, the total capital requirement, incorporating the minimum capital requirements, CCB, and the G-SIB buffer, would be USD 8.75 billion. This calculation is based on the risk-weighted assets (RWA) of USD 70 billion, derived from applying the appropriate CCF and risk weights to the different components of the SBLC portfolio.

The calculations provided aimed to quantify the capital requirement based on an 8% minimum requirement, a 2.5% CCB, and a hypothetical 2% G-SIB buffer. The total of these percentages (12.5%) applied to the RWA should accurately reflect the bank's total capital requirement under Basel III regulations for a G-SIB.

In conclusion, navigating the landscape of true sale participation on an unfunded basis is critical for US banks. Achieving true sale participation requires strategic structuring of transactions to optimize capital relief objectives. By embracing this process, banks can enhance their financial stability, operational flexibility, and compliance with evolving regulatory frameworks.

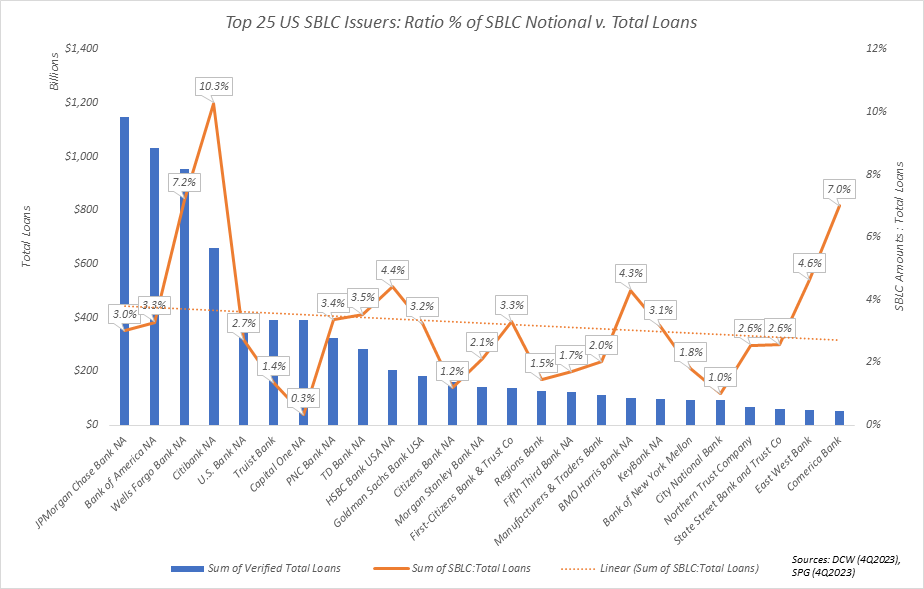

Furthermore, the complexities surrounding capital reserve requirements concerning SBLCs under Basel III and US regulations underscore the importance of a comprehensive understanding and strategic planning. These nuances significantly influence banks' capital management strategies and resilience against market uncertainties. When implemented correctly, all SBLC issuers benefit from engaging in the true sale unfunded risk participation marketplace. That said, many of the largest U.S. banks are classified as G-SIBs. These same banks carry the largest concentrations of SBLC exposure among domestic issuers and arguably stand to benefit most from unfunded risk trading.

Moreover, risk trading in SBLCs represents an attractive market for both bank and non-bank financial institution investors alike. The secondary market offers opportunities for investors to diversify their portfolios and manage risk exposure effectively. Therefore, incorporating SBLCs into true sale participation initiatives not only aligns with banks' capital optimization objectives but also contributes to the broader liquidity and stability of financial markets.

Clearly, by embracing true sale unfunded risk participation and proactively addressing the nuances inherent in capital reserve requirements, banks can be more intentional in how they manage their SBLC portfolios. It allows active management of geographical, sectoral, and single-name credit concentrations - freeing up capacity to originate and seek out attractive market opportunities. Such an approach ensures robust risk management practices and sustained operational integrity in an ever-evolving regulatory environment, while also harnessing the potential of SBLC markets to optimize capital utilization and enhance overall financial performance.

In essence, achieving true sale participation is not just a regulatory strategy but a strategic imperative for US banks looking to thrive in a complex and competitive banking landscape. Through prudent risk management practices and innovative approaches to capital management, banks can navigate the challenges of unfunded true sale participation and emerge stronger and more resilient in the face of evolving market dynamics.

[[1]]:In comparison to Europe, refer to the regulatory framework established by the Capital Requirements Regulation (CRR, Regulation (EU) No 575/2013) and the Capital Requirements Directive IV (CRD IV, Directive 2013/36/EU). According to these regulations, standby letters of credit are subject to a credit conversion factor (CCF) of 20%, as specified in the CRR

[[2]]:The USD 250B asset size is important as it indicates the threshold for the application of enhanced prudential standards under Reg. YY, are required to participate in CCAR and must meet additional liquidity requirements (as detailed herein)

Gain full access to analysis, cases, eBooks and more with a DCW Free Trial