DCW Monthly: April 2025

This month, DCW unpacks the legal and practical shifts reshaping trade finance interpretation. Why are ICC Opinions becoming increasingly scarce?

Another scenario discussed in the meeting of US west coast bankers centered around a commercial LC requiring under 46A:

1. FULL SET OF ORIGINAL(S) CLEAN ON BOARD BILLS OF LADING (THREE ORIGINAL AND THREE NON-NEGOTIABLE COPIES) MARKED ‘’FREIGHT PAYABLE AS PER CHARTER PARTY’’ MADE OUT TO THE ORDER OF METROPOLITAN BANK AND TRUST CO. METROBANK PLAZA SENATOR GIL J. PUYAT AVENUE EXT. MAKATI CITY, METRO MANILA, PHILIPPINES AND NOTIFY APPLICANT.

And under 47A:

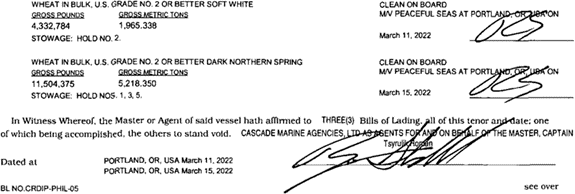

8. CHARTER PARTY BILL OF LADING ACCEPTABLE. An extract of the B/L presented showed:

Based on this extract and the LC requirements, is the charter party bill of lading discrepant or not? While the group of bankers did not express any concern about the two on board notations (ISBP745 Paragraph G5(h) would apply if there were two different ports of loading), a few bankers indicated they would refuse the B/L as it showed two different issue dates.

For some bankers, it was their first time seeing a B/L of this type. Others informed that it is quite common in the grain industry where it often takes multiple days to load and unload shipments.

In defense of the B/L issuers, and without preceding cases (UCP600 Article 22 does not address this variation), the two issuance dates coincide with the on board dates which can be construed as further affirmation of the loading on board, therefore the two issuance dates shown are immaterial.

It was disclosed that since the shipment involved a high value commodity, the negotiating bank opted to request, and succeeded, in obtaining a replacement B/L showing only one issue date. The negotiating bank’s action was taken as a safeguard and actually was not necessary.

Gain full access to analysis, cases, eBooks and more with a DCW Free Trial